Evolving programmatic capabilities for streaming TV

As streaming TV viewership grows, we’re beginning to see three distinct patterns in digital consumption throughout the same 24-hour period. Going back to the early days of programmatic on the web, we’ve seen a pretty consistent pattern where web traffic (and thus impression activity) ramps up steadily throughout the working day. It then peaks around midday and slowly tails off as commutes typically take people out of the office. Meanwhile, mobile traffic starts to pick up throughout the afternoon and evening as consumers shift devices.

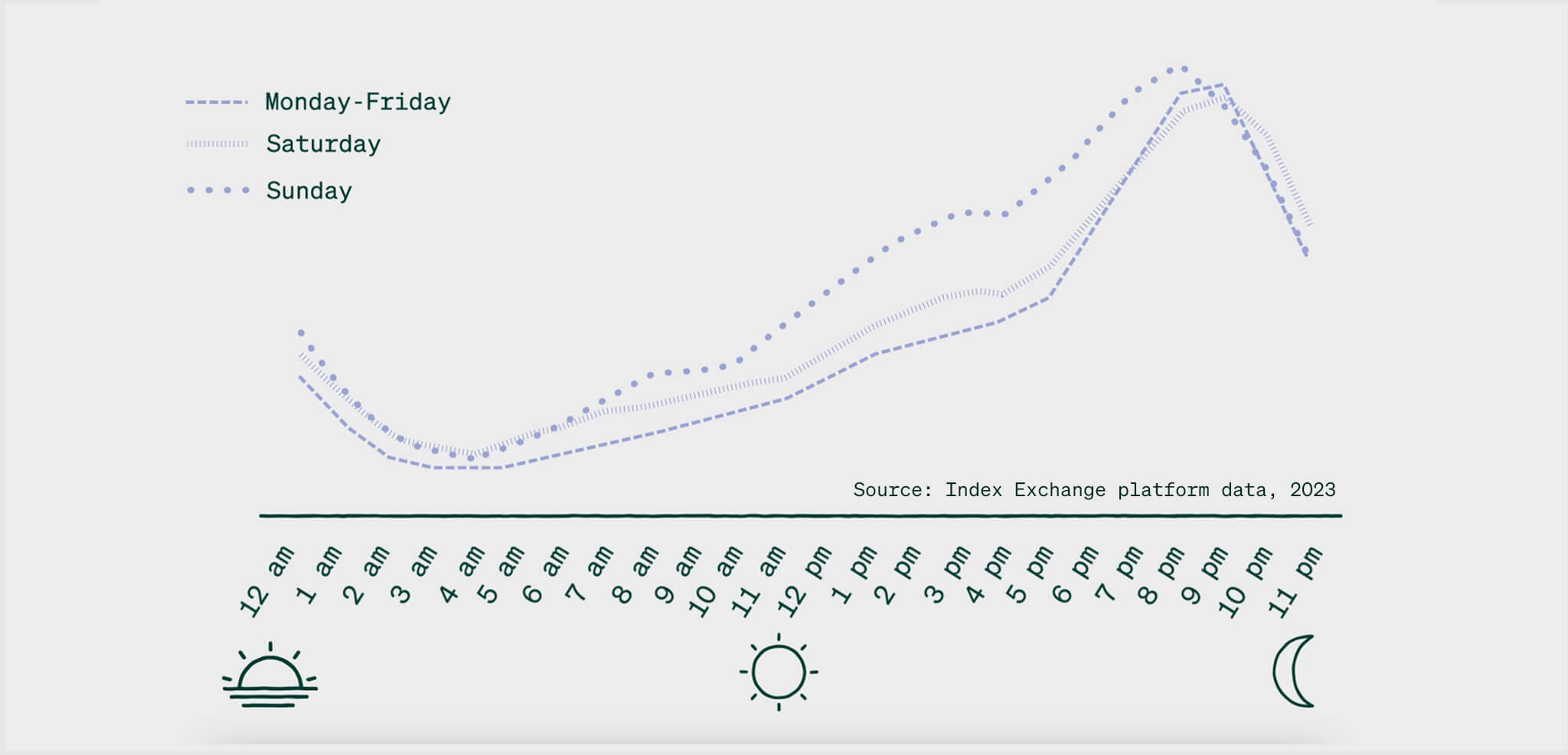

Streaming has now ushered in programmatic’s third consumption pattern within the same 24-hour period. TV behavior is very different from the web and mobile. Prime time TV has long been the place for marketers to advertise and capture attention. Tens of millions of viewers tuned in to network programs like ABC’s TGIF sitcom block, “Survivor,” “ER,” and “Sunday Night Football” between 8-11 pm nightly.

With streaming TV, viewers are often watching on demand, but the same prime time viewership trend holds true. As you can see in the below example from one streaming TV publisher, viewership clearly spikes between 8-11 pm.

On demand or not, old habits die hard, and we’re all creatures of habit and love our sofas—especially after a long day of reading OpenRTB specs.

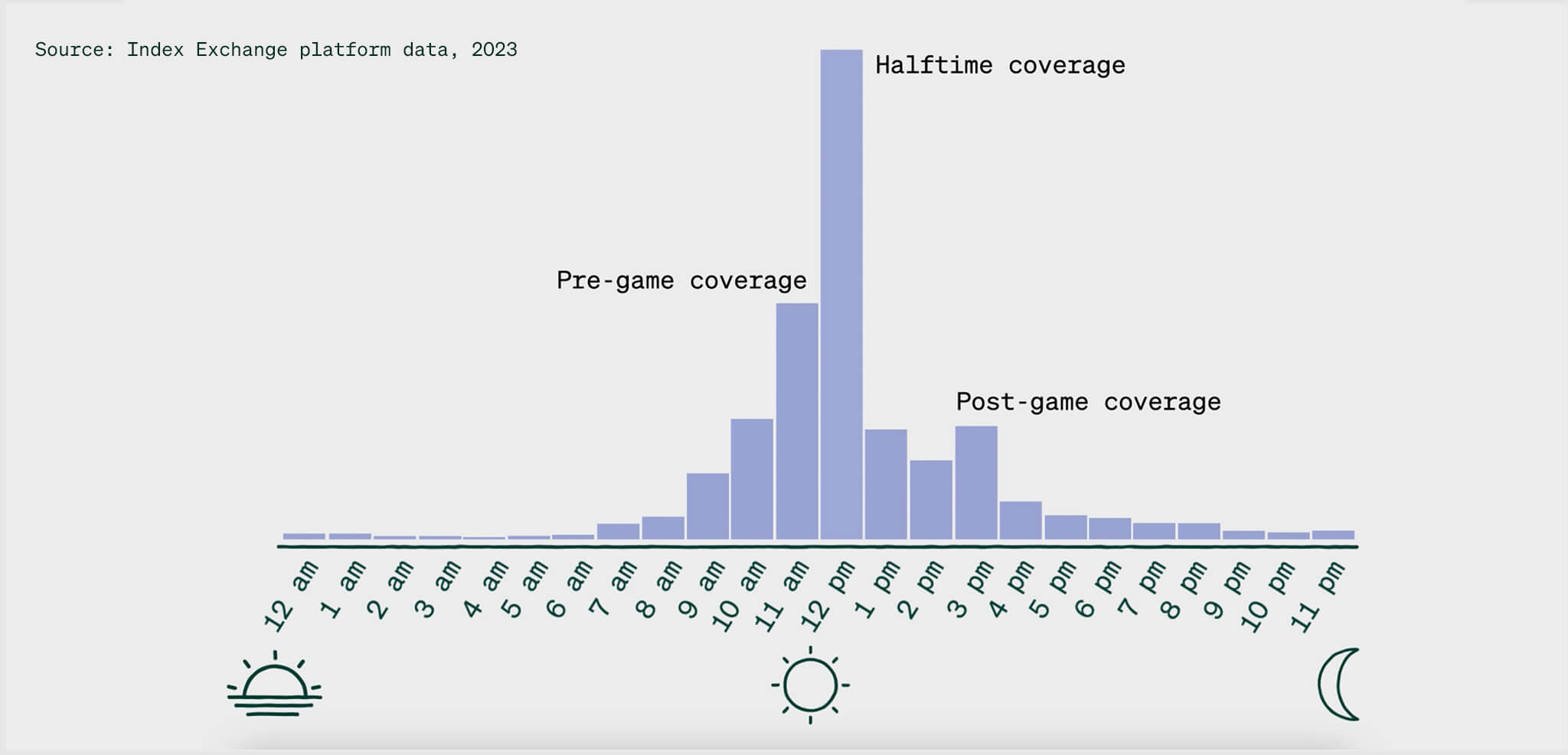

We often hear about on-demand viewing, but not all viewership happens on demand. As more viewers cut the cord and choose to stream sports and live events, millions of consumers are also tuning into live streams, and all at the same time.

Challenges with existing programmatic infrastructure

For programmatic to support streaming TV at scale, the infrastructure of all players in the ecosystem has to support high concurrent viewership condensed within just a few hours throughout the day. Infrastructure also has to support the high demand from buyers who want to reach this rapidly growing, highly desirable audience. Think of streaming activity as a mountain peak, compared to the rolling hills of web and mobile activity.

Simply put, programmatic wasn’t built with TV in mind, which has created new challenges that we’re seeing play out today.

One challenge is yield optimization. Media owners have to consider a wide variety of buyers that could have preferred or guaranteed buys in place. They also have to consider carriage agreements and inventory splits that they’ve struck with their network and device partners. This can get complex in any auction, but the stakes are heightened when you’re dealing with millions of viewers all tuning in during a short period. Any added latency—even 1,000 milliseconds—results in lost revenue.

Meanwhile, marketers want to maximize every opportunity possible to reach their audience. Optimizing for a full 24-hour day rather than the three hours of prime time or for a specific live event is going to result in a lot of inefficiency and missed opportunities to reach coveted audiences.

One of the most important considerations is pacing logic. If a buyer wants to target NFL football on Sundays, it’s not enough to create a campaign that runs for say, 120 days during the season. What ends up happening is that a DSP will over-index on the first few ad breaks as it responds to a spike in viewership and ad opportunities, and then not respond later. DSPs have to understand when and for how long events occur for even, optimized pacing.

DSPs also have to consider their queries per second (QPS) limits. QPS limits help manage efficiency and cloud computing costs, but if not optimized for viewership patterns, they can result in missed opportunities. Think about all of the activity that happens on the internet every second. Universally, let’s estimate that to be a QPS of about 10 to 20 million. Each DSP will set a much lower limit to match their business needs, maybe around 1 to 3 million QPS, which means they’ll miss out on opportunities beyond that.

Optimizing programmatic performance

What exactly does all of this mean for programmatic performance? Let’s look at another example. During a recent highly anticipated European football match, you can see the drastic spike in bid requests to fill all of the media owner’s ad pods during halftime coverage when ads run, and then a drastic drop in requests as the game resumes without ad breaks.

For a media owner to fill every ad pod, and for a buyer to maximize every opportunity to engage their audience, the infrastructure has to support high levels of traffic in relatively short bursts of time. Campaigns and algorithms must account for programming schedules to respond in a way that effectively paces a buyer’s budget.

The streaming TV market is scaling incredibly quickly and programmatic capabilities have to evolve to catch up. What worked for programmatic on the web won’t necessarily work for streaming. As ad tech races to innovate and close the gap between existing tools and the needs of TV buyers and sellers, it’s vital to remember just how unique streaming TV is from the rest of the programmatic market.

Learn more about the streaming TV opportunity.

Thank you to Jeff Saucerman, Martin Schaefer, and Kristina Gubanov, who also contributed to this video.